When I reread this prayer, I instantly remember my worry, anxiety, and fear. Scripture says, “do not be afraid,” throughout the Bible over and over, but it’s probably the hardest to obey.

You can tell I was scared because I pulled out my journal and began to write this in the MIDDLE of the business day…

[Retyped and elaborated for clarity and context…]

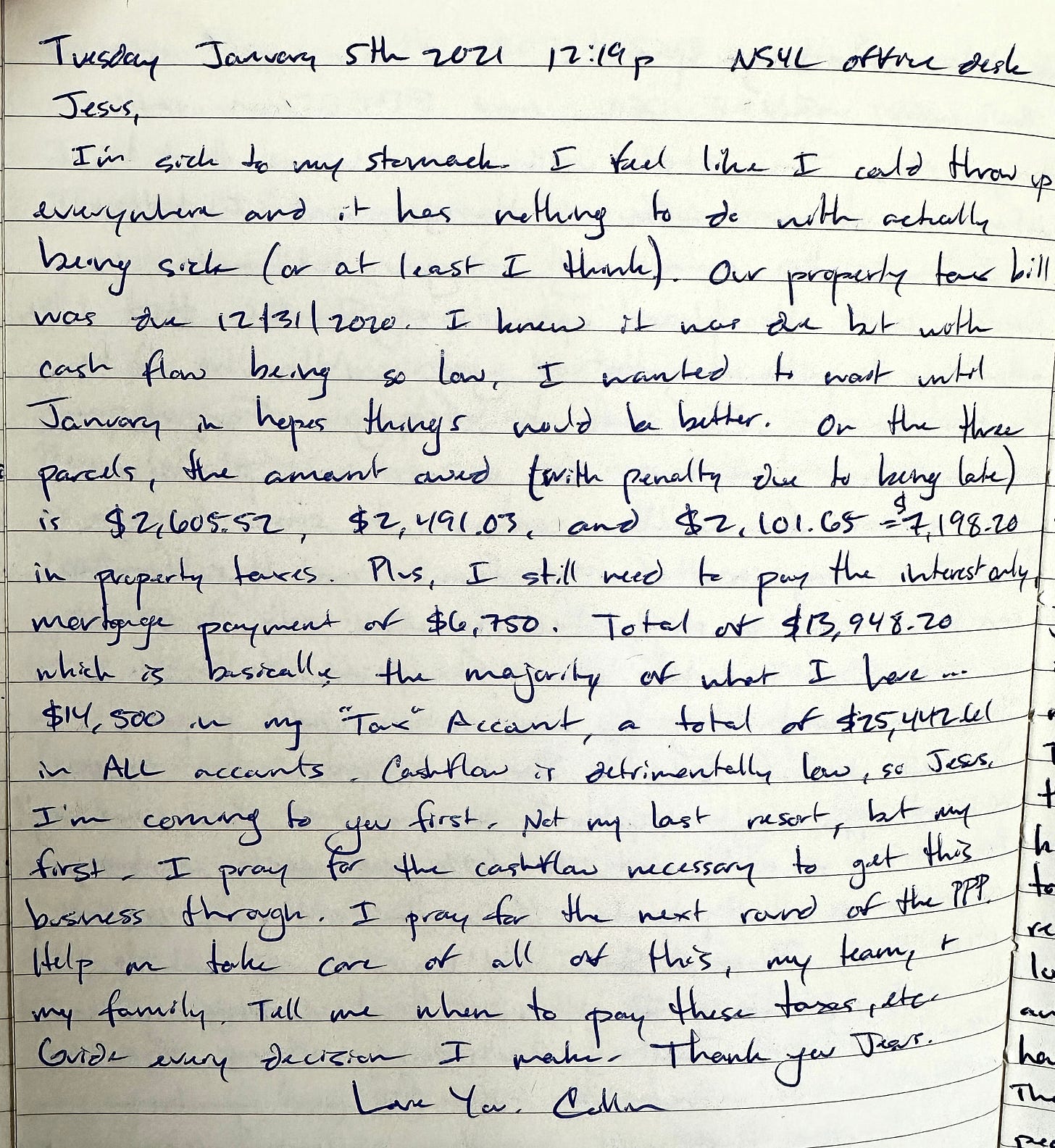

Tuesday, January 5th, 2021 12:19p NS4L office desk

Jesus,

I’m sick to my stomach. I feel like I could throw up everywhere and it has nothing to do with actually being sick (or at least I think). Our property tax bill was due on 12/31/2020. I knew it was due but with cash flow being so low, I wanted to wait until January in hopes things would get better.

[January is one of our busier months of the year due to the start of a new semester, but with the impact of Covid on our university town, I was unsure what to expect. The University of Florida was very much in a hybrid mode. Classes were in session, but many classrooms (from what I remember hearing from students) had social distancing requirements and limited classroom capacities. This means that most students were still watching their classes online and the need for a scooter would be limited. January 2021 ended up being our slowest January since the early years.]

On the three parcels, the amount owed (with a penalty due to being late) is $2,605.52, $2,491.03, and $2,101.65 = $7,198.20 in property taxes.

[I still consider myself a novice in commercial real estate, but I personally feel that the amount paid on property taxes is ridiculous. By the way, this $7,198.20 was for the 4th Quarter of 2020 ONLY and the penalty was only a small part of that. Our yearly property taxes are close to $30,000 for the year!]

Plus, I still need to pay the interest-only mortgage payment of $6,750. Total of $13,948.20 which is basically the majority of what I have… $14,500 in my “Tax” Account, a total of $25,442.61 in ALL accounts.

[In regard to the tax account mentioned… I use a system called “Profit First” by Mike Michalowicz that teaches to have multiple bank accounts instead of just one operating account and one savings account. Instead, you would have an Income account that later you move money from into a Profit account, Tax account, Operating Expenses account, and Owner’s Compensation account. I’ve expanded on it for my business to include an Operating Expense “Pending” account for checks I’ve already written, an Emergency Fund account, and a couple more. Without going too deep into it, it’s an awesome system and I believe every business owner should operate their business with this method. It’s great for gaining a daily cash flow picture and helping you allocate accurate percentages of your business’s income to the proper places. If interested in a summary, there are great summary videos all over YouTube. I’m also happy to have a conversation if you want to reach out. Mike’s book, Profit First, is the best resource for setting this system up though.

Having $25,442.61 in all bank accounts and knowing that $13,984.20 was already allocated, thus leaving $11,458.41 to operate on with payroll right around the corner, is one of the scariest moments in my entrepreneurial career.]

Cashflow is detrimentally low, so Jesus, I’m coming to you first. Not my last resort, but my first. I pray for the cash flow necessary to get this business through. I pray for the next round of the PPP. Help me take care of all of this, my team, and my family. Tell me when to pay these taxes, etc. Guide every decision I make. Thank you, Jesus.

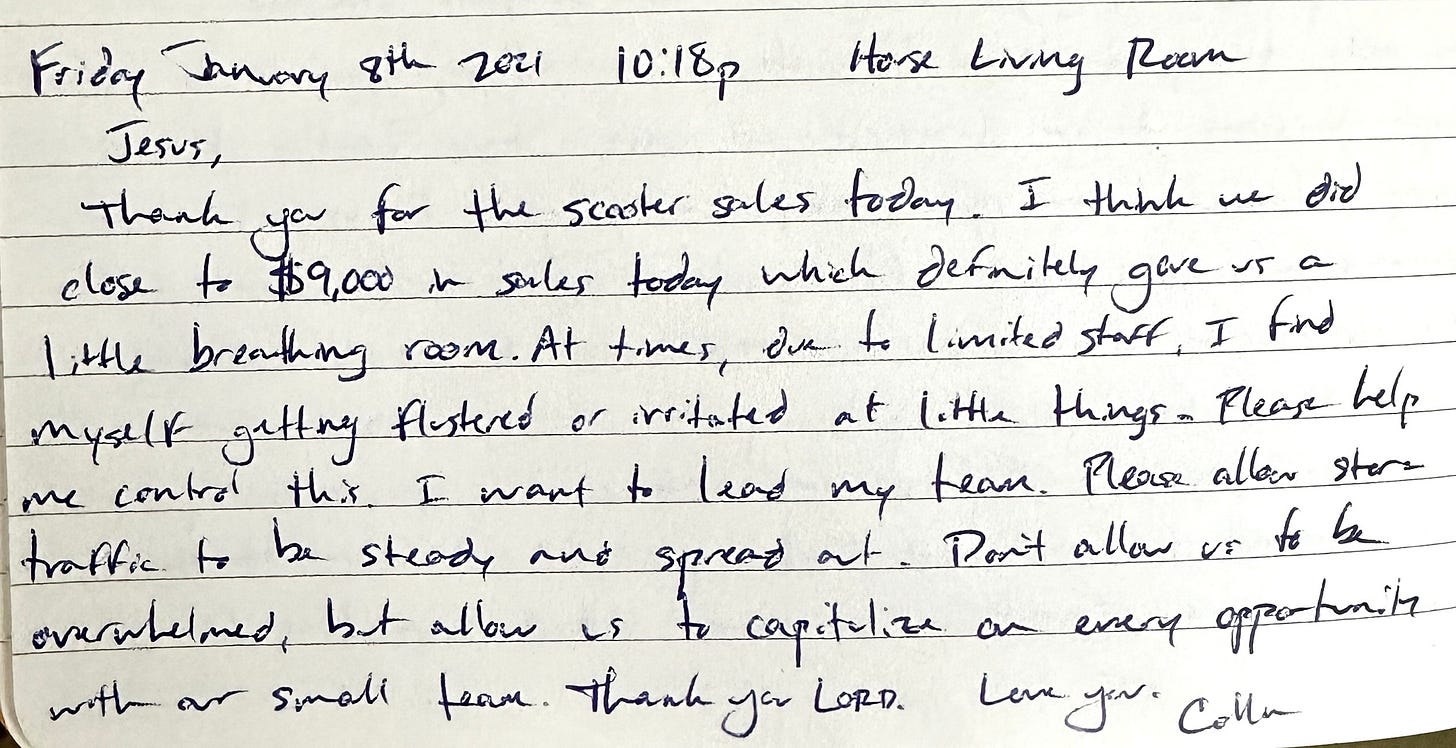

[3 days later we would do almost $9k in sales on January 8th, 2021, (see quick prayer journal entry below) and about a week later we received the 2nd round of PPP. Thank you, Jesus.]

Love you.

Collin

Today’s final thoughts

One area I want to consistently grow in is praying all the time - throughout the entire day - and even more so when things are great and not only when things are bad. Today, I find myself saying, “Thank you, Jesus” immediately after a sale and I love being in that state of gratitude.

May God bless you in the week ahead. Thank you for reading!

Collin

If this is your first time visiting my blog, please read about it here and please subscribe. Thank you!